SUVA, FIJI (28 February 2025) – Merchant Finance Pte Limited (“Merchant Finance”) is proud to introduce two of its innovative financial products designed to support existing or new landowners across the country. The Land Loan and Land Subdivision Loan products aim to provide affordable financing solutions, promote land ownership, and improve living conditions for Fijians.

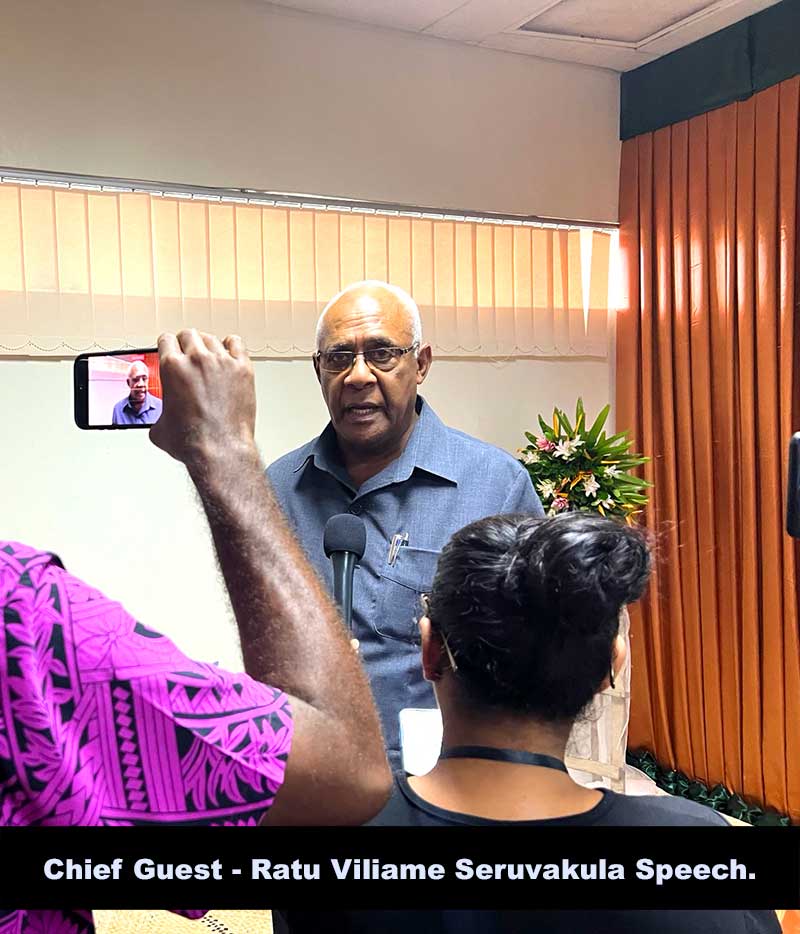

The Land Loan and Land Subdivision Loan Products was officially launched by the Chairperson of the Great Council of Chiefs, Ratu Viliame Seruvakula on the 27th of February, 2025. At the event, Merchant Finance Chief Executive Officer, Mr. Veilawa Rereiwasaliwa provided an informative presentation highlighting the key features and benefits of the two products.

Land Loan Key Features and Benefits:

- One of the lowest deposit requirements: A deposit of only 10% makes it easier for individuals to secure land for residential purposes.

- Interest rate of 10% on reducing balance, with a loan term of up to 10 years.

- Merchant Finance funds agreement for leases for residential purposes.

Land Subdivision Key Features and Benefits:

- Market Leadership: as the only product of its kind in the market, it sets a new standard for land development financing in Fiji.

- 100% financing for civil work: Covering the costs of infrastructure development, such as roads, drainage, etc to ensure subdivided land is habitable.

- Government-Backed Interest Subsidy: A unique fixed interest rate subsidy provided by the Government, targeting indigenous landowners for the first 3 years – making the product more affordable.

Merchant Finance is committed to supporting the expansion of land ownership and development opportunities in Fiji. This is highlighted through the approval and disbursement of Land Subdivision Loans of $16 million, to seven approved customers. Out of the seven, two customers have completed their subdivision and the remaining five are currently in progress.

In addition, Merchant Finance is working on the loan application for 10 more land subdivision projects worth $20 million across the country. Increasing the demand for land subdivision development produces more job opportunities for engineers, laborers and other service providers. It also contributes towards a growing housing market which in turn stimulates economic activity.

Additionally, the Government backed interest subsidy ensures that indigenous landowners can unlock the value of their land while retaining ownership. Through the introduction of these financial products, Merchant Finance aims to finance up to 2,000 lots over the next three years, contributing to an increased supply of land and housing solutions.

This initiative is expected to generate significant positive impacts by providing accessible and affordable financing options, particularly benefitting individuals residing in informal settlements, existing landowners and those seeking land ownership opportunities.

Click to view our Land Loan & Land Subdivision Loan Products Launch Speech.