Merchant Finance Pte Limited (“Merchant Finance”) is excited to announce the launch of its Zero Deposit Home Loan Product. This ground-breaking product is anticipated to transform the homeownership landscape in Fiji, offering an accessible opportunity for Fijians to become

First Home Buyers.

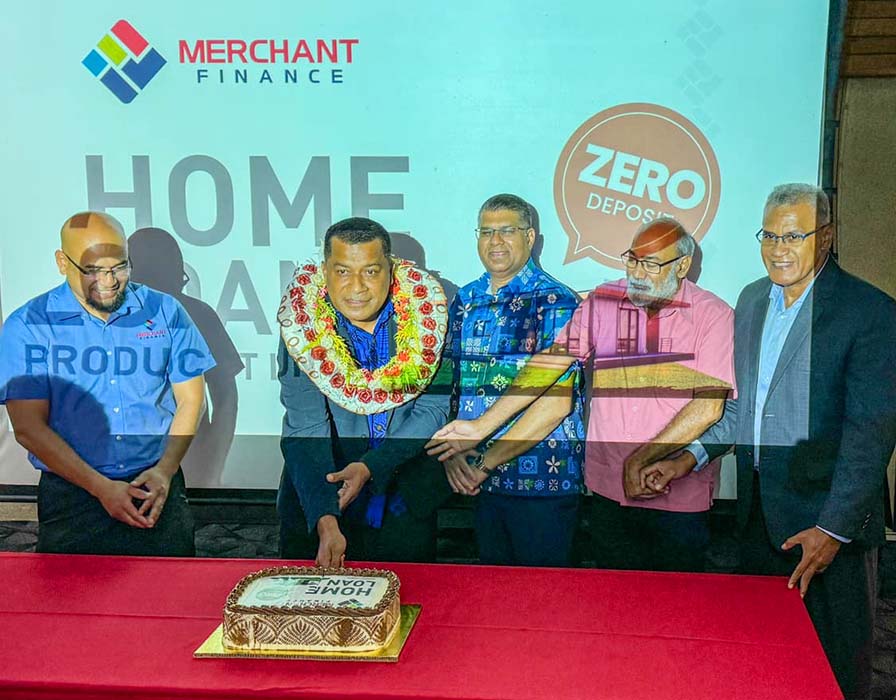

The much anticipated Zero-Deposit Home Loan Product was officially launched by the Honourable Minister for Housing and Local Government Maciu Nalumisa on the 30th of January, 2025. At the event, Merchant Finance Chief Executive Officer Mr. Veilawa Rereiwasaliwa provided an insightful presentation on the zero-deposit home loan product, highlighting the key features and benefits as follows:

- Zero-Deposit for First Home Buyers

- Up to 90% of financing available on home construction loan;

- Competitive interest rate for First Home Buyers with combined income of $50,000 and below

- No compulsory cyclone insurance needed for central division

With existing government housing mechanisms, Fijians can strategically leverage government grants and facilities to complement the Zero-Deposit Home Loan product and become First-Home buyers.

The introduction of this product closely positions itself with the Government’s ongoing efforts to improve housing accessibility and affordability, reinforcing national policies aimed at fostering inclusive economic development.

Merchant Finance is committed to providing practical solutions that align with the vision to be the preferred financial services provider in Fiji. Developing a comprehensive suite of tailored financial services, such as the Zero-Deposit Home Loan product, makes homeownership a reality for Fijians.

One such individual is Naomi Navoce, a person with disability who has been renting for most of her years. Despite stable employment, Naomi encountered barriers when approaching financial institutions to be able to sign up for a home loan product that would allow her to finally construct her first home.

“Every step I took, I encountered obstacles that made homeownership feel out of reach. From employment contracting issues to the burden of a compulsory deposit,” shared Ms. Navoce. “When I heard about Merchant Finance’s upcoming Zero-Deposit Home Loan, I knew this was an opportunity I could not miss.” Ms. Navoce emphasized that her circumstances should never be a barrier to homeownership. She expressed deep appreciation for Merchant Finance’s inclusive approach, stating, “the approval of my home loan application can be considered as a first for a person with disability to secure a home loan and be able to build their dream home.”

The Zero-Deposit Home Loan Product will prove to be an additional catalyst in positively shifting the numbers of home ownership in Fiji. This exceptional opportunity makes homeownership more attainable for everyday Fijians.

Additionally, in the coming months, Merchant Finance will continue to introduce new products and services designed to further enhance the financial landscape in Fiji.